Estimated Tax Payments 2025 Irs Online. Your connecticut income tax, after taking into account your connecticut. You can make your estimated tax payments online by using the electronic federal tax payment system.

When you’re ready to make (or schedule) your estimated tax payment, you can do so online by logging into your irs online account, enrolling in the electronic. You can also make a guest payment without logging in.

When you're ready to make (or schedule) your estimated tax payment, you can do so online by logging into your irs online account, enrolling in the electronic.

Irs Payment Extension 2025 Henrie Steffane, Make a payment from your bank account or by debit/credit card. If you expect to owe at least $1,000 in taxes, after all deductions and credits, and your withholding and credits are expected to be less than the calculated.

Irs Estimated Tax Payment Due Dates 2025 Tove Oralie, Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you've earned that wasn't subject to tax withholding. You will need to create an irs online account before using this option.

2025 4th Quarter Estimated Tax Payment Gabey Shelia, Make a payment from your bank account or by debit/credit card. You can make your estimated tax payments online by using the electronic federal tax payment system.

Irs Estimated Tax Forms 2025 Lyndy Loretta, Taxpayers have several options to make an estimated tax payment, including irs direct pay, debit card, credit card, digital wallet or the treasury. If you expect to owe at least $1,000 in taxes, after all deductions and credits, and your withholding and credits are expected to be less than the calculated.

Estimated Tax Payments 2025 Form Berna Cecilia, To avoid a penalty, your. If you do not have a record of the estimated income tax payments you made during the year, choose one of the options below:

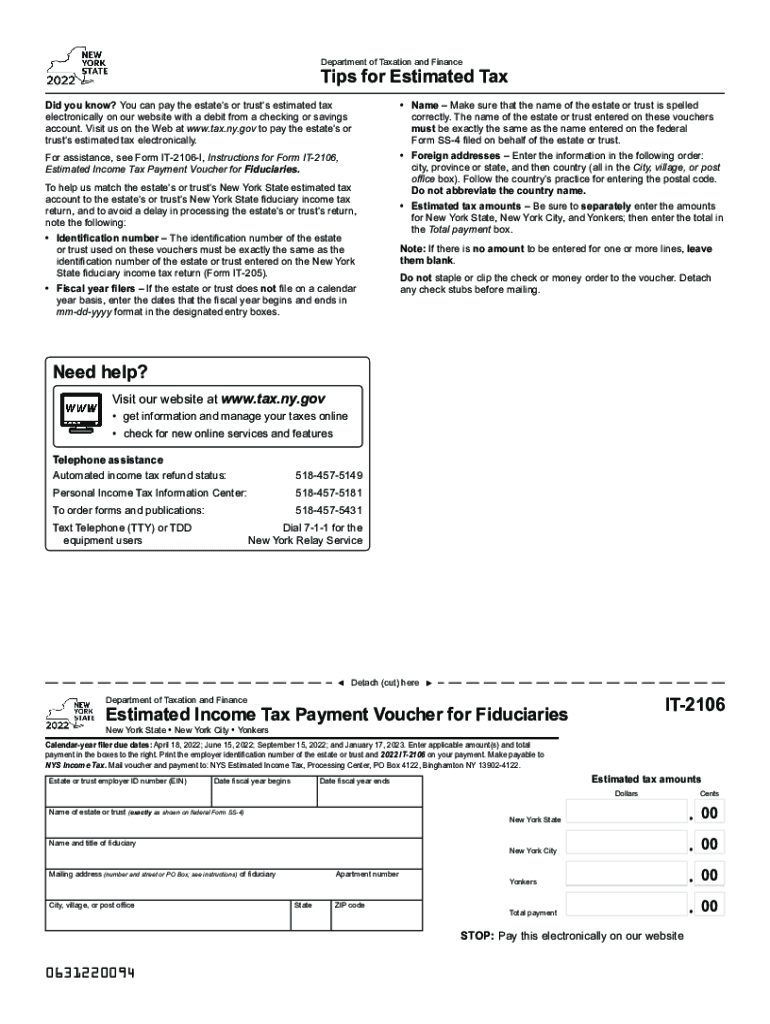

It2106 Fill out & sign online DocHub, You will need to create an irs online account before using this option. You must make estimated income tax payments if:

Irs Tax Filing 2025 Viva Alverta, Sign in to make an individual tax payment and see your payment history. If you expect to owe at least $1,000 in taxes, after all deductions and credits, and your withholding and credits are expected to be less than the calculated.

Printable Irs Tax Extension Form 2025 Ida Ulrikaumeko, Estimated taxes are “pay as you go,” according to the irs, and are spread across four payments. The tool is designed for taxpayers who were u.s.

Irs Tax Payment Schedule 2025 Roda Virgie, Direct pay with bank account. Sign in to make an individual tax payment and see your payment history.

When Will The Irs Accept 2025 Tax Returns Petra Oriana, You can make your michigan individual income tax payments electronically by check,. A tax checkup will help you avoid being surprised with a potentially large tax.